The Broadband Equity, Access, and Deployment Program (BEAD), created via the enactment of the Infrastructure Investment and Jobs Act (IIJA), represents a transformative shift in U.S. federal broadband subsidies in both size and scope. BEAD provides $42.5 billion to expand high-speed broadband across all 50 U.S. states, Washington D.C., Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands; this is approximately four times the size of previous federal subsidy programs. The opportunity is immense, and the requirements for accessing the BEAD program are uniquely complex. Moreover, the complexity of the federal rules that states must comply with is amplified for grant applicants, who will have to navigate multiple state programs with differing goals and structures.

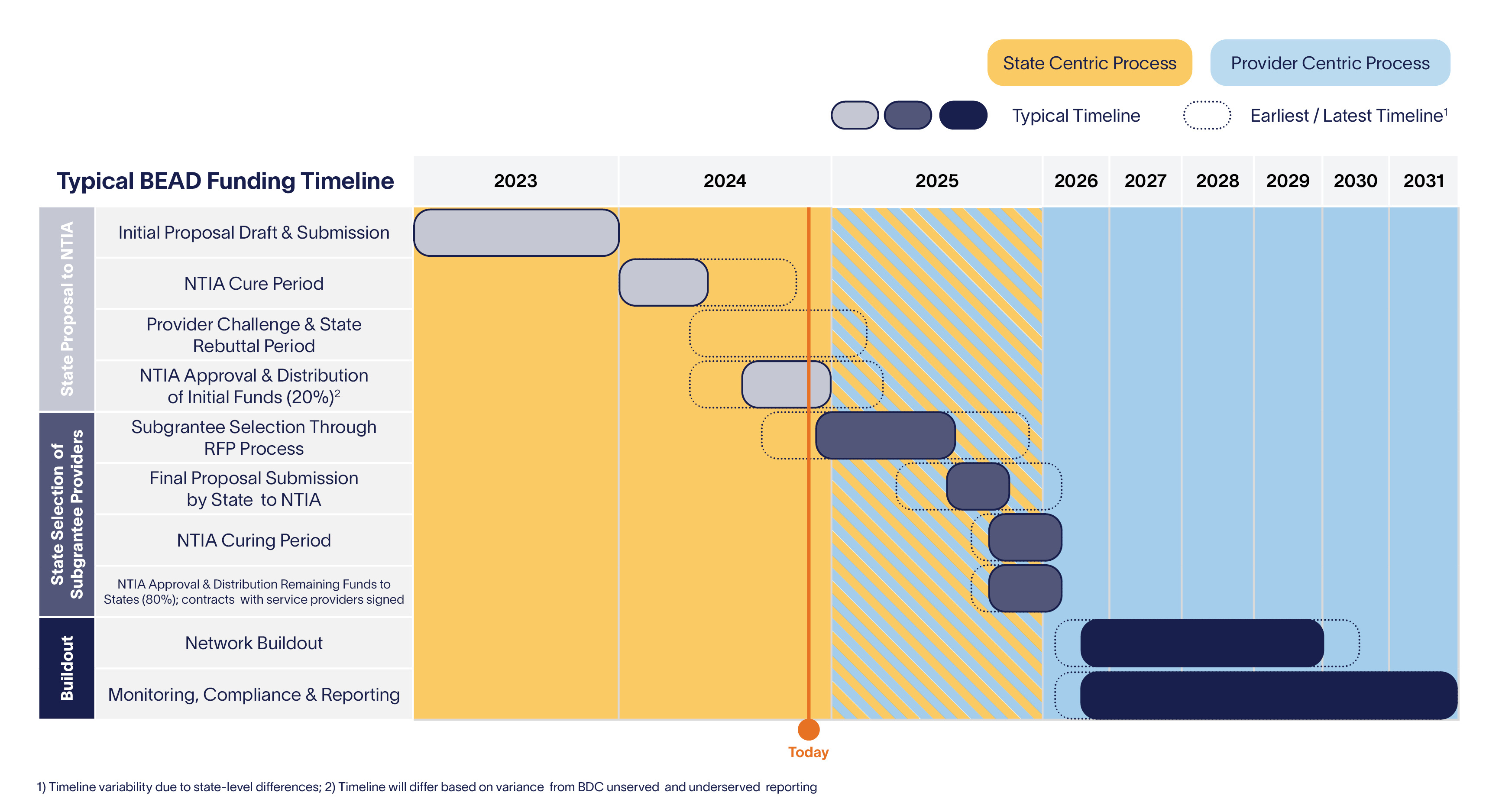

While grant allocation to states began in 2022, we predict that authorizations for states to expend funds will speed up over the next 12-plus months as the National Telecommunications and Information Administration (NTIA) approves state plans and application windows for grants open.

We are currently in the cure period of the Initial Proposal phase, with states and territories submitting documentation to remedy gaps in their Initial Proposal Volumes I and II, and a small group of states already approved. Once approved by NTIA, a state or territory will have a year to structure and execute its grant program. We expect the next 12 to 18 months to be a massive effort for states as they define their RFP process, finalize RFP terms, draft contracts, execute processes, evaluate applications, and select subgrantees.

Meanwhile, providers (telecommunications companies) and investors will need to prepare for this opportunity as each state and territory will award over 100 grants on average. Providers may be saddled with filing hundreds if not thousands of applications across multiple states with differing requirements. Thanks to our years of experience supporting government entities, providers, and investors in developing and accessing subsidy programs, we have identified five critical considerations for states and potential applicants over the next 18 months.

I. Prepare for successful applications and post-grant operations

In the coming months, states and providers will have their hands full, completing the necessary tasks to select grant award winners or complete BEAD funding applications. While the requirements of Initial Proposal Volume 2 have forced states to structure their grant processes, there has been little thought into post-grant operations. States should define these processes now, before awarding grants and signing contracts. Issues like the monitoring process, penalty process and schedule, notification requirements, cure periods, step-in rights, claw back rights, windfall protections, and other provisions typical in large infrastructure investments should be stipulated.

Providers' and investors' time is also limited. They need to understand processes across multiple states and territories and enter tens to hundreds of applications, including multiple rounds. Providers and investors should be prepared for a large volume of applications over a short period of time. Setting up systems to manage this process, with quick response teams, will be essential for successful bids.

II. Understand and plan for complex revenue potential

NTIA has offered extensive guidance on costs but has provided minimal information about the revenue potential of new networks. This is due in part to their complexity. A provider’s revenue varies by factors like demographics, competition, and business models. For instance, cable providers with TV revenues can often justify higher net present value (NPVs), capturing more awards, similar to electric co-ops that enjoy cost and revenue synergies. Providers and investors need to understand these dynamics for strategic planning. States must also be aware that NTIA's models are most likely limited, as they assume greenfield deployment and may not offer much guidance, leading to locations without bids or significant profits for some providers. Effective bid-side modeling should include comprehensive revenue projections.

III. Anticipate strategic gaming

Per their initial plans, most states are choosing to run their application processes based on flexible territories formed by provider-selected units. Put simply, this means it's up to providers to define the service territories and grant-eligible locations within those territories that they’ll serve. They are also leaning towards multi-round bidding procedures that include a negotiation stage, opening possibilities for strategic gaming.

For providers, some of the key questions are: Should I "high bid" in the first round with the hope of facing no competition and securing an award? Should I target a mix of attractive and less attractive units to create a viable package, or should I focus solely on the most appealing parts to maximize my score? Should I avoid bidding on certain territories to preserve options for the second round of the negotiation phase involving high-cost locations? The answers to these questions are not straightforward and will differ across states, depending on each state’s specific process, the provider’s strategy and situation, and its competitors. However, effectively navigating this complexity can result in a positive and profitable outcome.

Conversely, for states, budgets may not stretch as far as expected, leaving eligible locations potentially underserved or unserved. Creating a process that minimizes these strategic manipulations, while considering the state's distinctive physical and demographic characteristics and supply conditions, will be critical for maximizing the value of available funds.

IV. Post-award execution will be difficult, but not in ways expected

Many states plan on implementing IT-based grant management systems to monitor the progress of subgrantees and issue payments, similar to Medicaid grants. States are looking for IT providers with pre-packaged solutions that can be customized. However, broadband grants will be radically different than previous state-run federal grants.

Each state will have a smaller amount of subgrantees (in the hundreds as opposed to thousands with Medicaid). Monitoring criteria will be much more complex, as will intervention criteria. Instead of focusing on IT solutions, states should get clear on their post-grant processes as this is a critical determinant of complexity, and active monitoring will be more challenging than technical implementation.

As subgrantees, smaller providers may be out of their comfort zone as they navigate complex project finance structures. They must familiarize themselves with issues like payment criteria and penalty regimes, and monitor contractual risks. They should proactively develop response processes to challenges from states and intervention processes that leverage internal resources and subcontractors.

V. Proactive planning is key to avoid regulatory claw-backs

Providers will face new challenges with regulatory compliance, such as Build America, Buy America (BABA), the National Historic Preservation Act (NHPA), and 2 CFR 200 Uniform Guidance. States risk losing grants if these rules are not followed, often passing this risk to providers. This task is complex for both sides. States must ensure funds can be recovered years later, while providers must adapt to unfamiliar practices like thorough record-keeping and reporting. Providers will be exposed to substantive risks, even years after funds have been awarded and construction completed. Proactive planning is essential for this.

Designed to bridge the digital divide, BEAD is an ambitious infrastructure project that holds huge promise for stakeholders in government and the private sector. Careful planning is key for all actors, including states, counties, cities, telecommunications companies, and investors.