Small cells are widely becoming a necessary component of wireless densification and new 5G networks, particularly in densely populated areas. Over the past decade, small cell deployments have grown almost 400% across U.S. markets, with plans to deploy tens of thousands of new small cells every year. Recent industry reports project small cell deployment to grow by 800% over the next decade.

But the reality tells a much different story of current deployments. Altman Solon’s internal research – which consisted of collecting and mapping small cell locations and permits from many U.S. cities – reveals that small cell growth has been much slower historically than what industry reports have projected due to the regulatory climate, lack of neutral hosts, and limited backhaul. In addition, all of these factors are occurring amid the COVID-19 pandemic, which has created construction availability shortfalls across the wireless communications industry.

While the drivers vary by city and region, our research suggests that regulation and fiber backhaul are the greatest constraints in the market today. Nevertheless, we believe that these barriers will shrink in the future, but likely at a very localized level (i.e., easier permitting in a specific city/state or fiber provider expanding their network).

Dense urban areas, small cell vendors still drive market

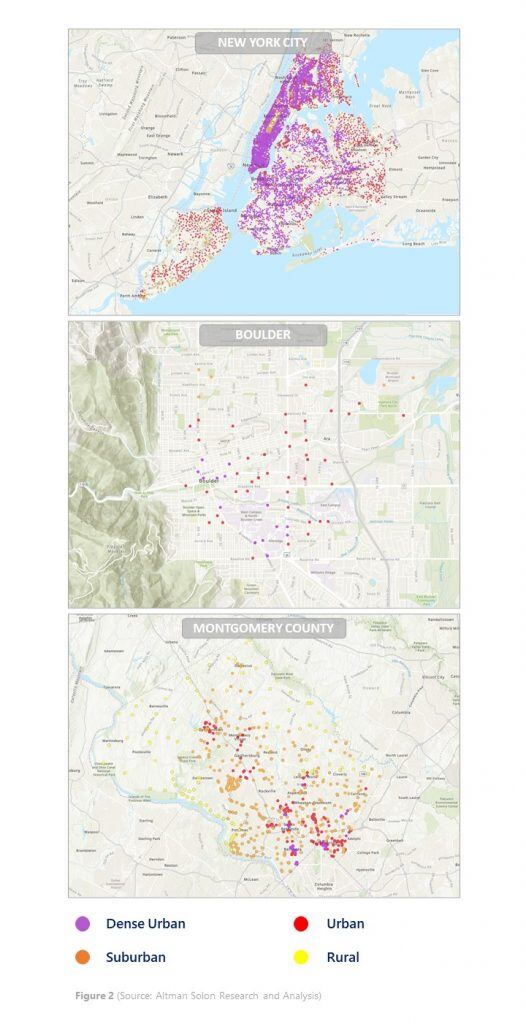

Based on our analysis, approximately 70% of all identified small cell nodes are in dense urban and urban areas where data demands are concentrated and most 5G deployments have started. Unsurprisingly, Crown Castle appears to be the leader in third-party small cell deployments. In fact, small cell vendors, like Crown Castle, are registered as the owner/deployer on about 50% of small cells identified, followed by Mobile Network Operators (MNO), which account for approximately 35%.

There is no “one size fits all” small cell regulation

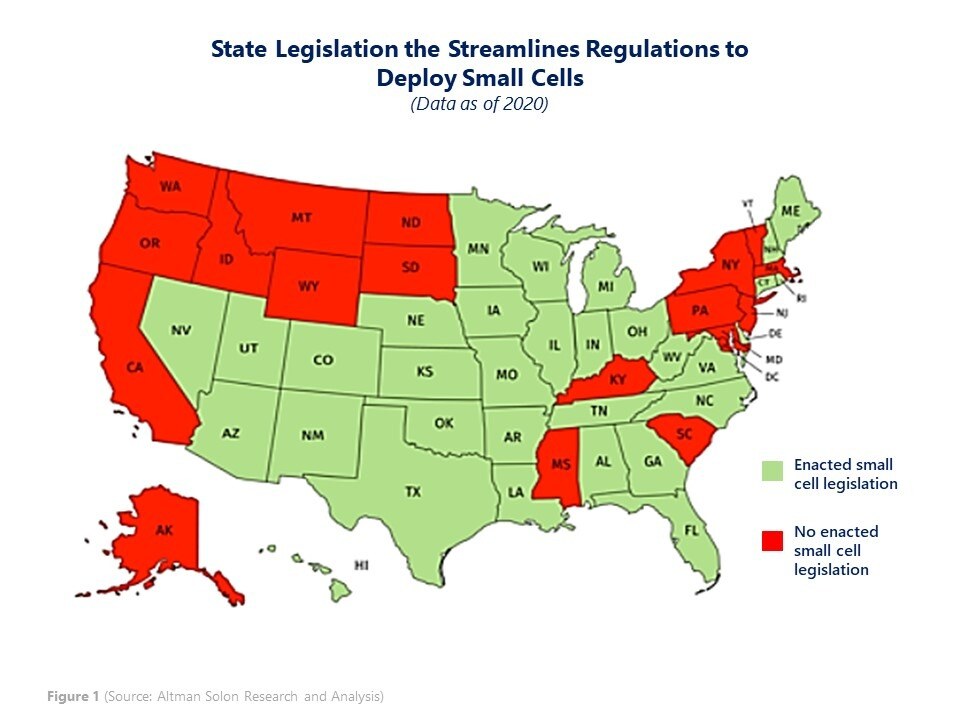

Regulatory challenges continue to be a roadblock to accelerating the small cell activity. While a 2018 Federal Communications Commission’s order attempted to reduce regulatory requirements for small wireless facilities (“90-day-build and 60-day-colocation procedural shot clocks”), local municipalities continue to hold authority over small cell deployment. As of last year, more than one-third of the United States, including many with major markets, had not yet enacted this small cell legislation.

Within these states, separate cities and/or counties may also choose to enact their own small cell regulation. Dozens of local cities and counties have resisted the FCC ruling, all for varied grievances, in favor of their local ordinances. Some entities have banded together to file joint lawsuits against the FCC (including one led by San Jose and Los Angeles and another led by Seattle), while smaller cities like Brookhaven, Georgia, or Montgomery County, Maryland, filed individual lawsuits. In other metropolitan areas, such as New York, Boston, and Chicago, cities have outlined specific rules for access to city infrastructure to continue aggressive deployment following significant market demand.

This individual flexibility gives rise to varied, custom approaches to deployment processes and requirements. From the aesthetics and design standards to application processes, and tenancy and free structures to “shot clock” timelines, almost all of these aspects affect the ease of small cell deployment and vary significantly by city. Even if the permit is approved, there are still many administrative steps to work through before the small cell is installed and “on air.”

For carriers and providers, this means a “Goldilocks” market strategy doesn’t exist. The main solution to navigating each complex regulatory environment has impacted the pace of deployment.

Small cells are popping up outside of urban areas

Optimistic forecasts currently assume small cells proliferate in regions with the “largest number of potential customers.” This would imply a continued focus on deployments in dense urban and urban areas, due to existing infrastructure and high impact to coverage.

While the majority of small cells still exist in dense urban and urban regions, according to Altman Solon analysis, morphologically suburban1 areas are seeing almost equal small cell deployments to dense urban areas. In fact, 2019 and 2020 saw the highest small cell deployment to date in suburban areas.

Still, deployment patterns across markets are largely erratic. Over time, small cell installations have a “lumpiness,” or develop multiple peaks and valleys in the pace of deployment following a lag of regulatory changes that typically follow existing process changes and/or new process implementations.

Small cell markets across the U.S. can be segmented by their current stage of deployment:

- Populous metropolitan cities such as New York, Boston, and Chicago have had small cells deployed for at least 4 to 5 years, established franchise agreements with major carriers, and tend to be dense urban or urban populations. These are typically the leaders in small cell growth in the U.S.

- Growth locations such as Boulder or Fort Worth – mid-size population densities often with deployments in a “Central Business District” – also have a few (3-5) years of small cell history though currently established processes and are continuing to evolve and mature.

- Early-stage areas of suburbia, where small cells and outdoor Distributed Antenna Systems (DAS) are proliferating, such as Montgomery County, MD.

The market segment differences in small cell deployment stages can be seen in the below image.

While neutral host small cells are considered by the industry as the Holy Grail, Altman Solon research shows that their deployment has been more limited than initially thought. Permit data shows that in multiple cities, sites that appear to be neutral host cells are actually outdoor DAS deployments in high-income neighborhoods with stricter design standards.

In theory, the neutral host model has clear advantages: new tenants can use the same pole, improving economics for the neutral host operator while more efficiently using city infrastructure. Markets such as Baltimore and Washington D.C. have reported or are pushing the adoption of alleged neutral host “small cells.” In reality, our research has identified very few truly small cells with multiple tenants.

Our Research

Recognizing the lack of comprehensive small cell market size despite the critical importance of wireless densification approaches and 5G networks, Altman Solon has built a database of small cells across 70+ U.S. markets. Leveraging analysis of this database and augmenting with other primary and secondary research and our deep experience and knowledge base in the space for all small cell ecosystem players, Altman Solon has developed preliminary critical insights about the competitive landscape in the U.S. small cell market.

Altman Solon will continue to expand on this research by updating the database with additional markets, developing small cell market-level predictive capabilities, and building case studies on iconic markets. This research informs the work we do with investors, small cell and in-building wireless providers, as well as other members of the wireless ecosystem.

Contributors

Elisabeth Sum, Jenny Kane, Adrien Fedida, Josh Lange

1“Morphological suburban” areas also include suburban areas in dense urban or urban regions.