INSIGHTS

The Field Services Market, Hybrid Work, and the “Ultimate Hybrid Work Bundle”

New Ways of Working Drive Demand for Technology and Employee Support

Nearly two and a half years since the onset of the COVID-19 pandemic, employees are adapting to a new normal of hybrid work. A June 2022 study1 found that approximately 45% of full-time employees in the United States are fully remote or in a hybrid working arrangement. As employers respond by expanding support for employees increasingly reliant on a functional home office setup, demand for products, IT services, and insurance coverage is also on the rise. This presents an opportunity for the field services market, inclusive of retail-based consumer electronics repair services and mobile field services, which is currently experiencing a glut of vendors offering similar services. Expanding target customer segments and forging partnerships with adjacent industries, such as insurance providers and device OEMs, can drive growth and carve out a competitive advantage.

The Opportunity for the “Ultimate Hybrid Home-Work Bundle”

Before 2020, Work from Home (WFH) was not a common term in the business lexicon. While advancements in communications tools allowed for remote workers to log in from home or other locations, the COVID-19 lockdowns that forced workers out of centralized offices quickly changed the culture – and sheer volume – of working from home. Early in the pandemic, Altman Solon explored the current and future patterns of WFH in an analysis that estimated 62 million Americans were working from home in 2020, including up to 50 million in technology or other knowledge-focused jobs. The report predicted that approximately 20 million knowledge workers would continue the WFH trend after the pandemic ended, supported by existing and new innovations enabling better remote communications and collaboration.

With the pandemic-related work shutdowns mostly over, it is clear that a large portion of the workforce is still working remotely in some capacity with new hires at most companies still receiving WFH stipends. In addition, the large WFH investment by employers at the beginning of the pandemic is in the third year of its lifecycle, indicating that a renewal of those technologies is imminent. In the past few years sophisticated cybersecurity threats, many targeting remote – or outside the perimeter workers – have emerged, pressuring employers to ramp up IT security training and strategies.

There has also been a shift as to the type of WFH investments employers are making. While the beginning of the pandemic saw a spike in the purchase of microphones and cameras to support online meetings, the hybridization of work and the proliferation of Internet of Things (IoT) devices is presenting several new growth opportunities for the field services market. Operators can consider providing home office setup services for remote workers, creating a marketplace for home office equipment, making white-label IoT offerings available to consumers, and offering technology repair services to address malfunctions to meet emerging demands from remote workers.

This extends into the workplace, as organizations with legacy in-office work models evolve towards a hybrid structure, requiring changes to their office space. To provide an added layer of security to both consumer and business segments, field services operators are beginning to explore the value of partnerships with insurance carriers – a trend likely to evolve in the years ahead. Combining these products, services, and insurance offerings – creating an “ultimate hybrid work-home bundle” that is easy to configure and purchase – represents an attractive and timely market opportunity.

The Field Services Market Is Increasingly Competitive, Forcing Many Players on the Offensive

In the current $19.4 billion market2 for electronic and computer repair services, companies are resorting to cost reduction measures to preserve profit margins, which are slightly below market expectations at 6.3%. Broadly, the repair ecosystem is increasingly competitive, forcing players to act aggressively and move into adjacent businesses or risk being left behind. Split between B2B and B2C, providers either act as a third-party repair service provider on behalf of OEMs and carriers or serve as both a return channel and full-service repair processor.

Market Tailwinds: Hybridization of Work & Internet of Things

Several market trends are driving demand for a new kind of field service provider and facilitating the diversification of revenue sources in their business models.

- Hybridization of the Workplace: Hybrid and remote work-related opportunities are expected to continue to increase through 2023. With 30-50% of the workforce expected to remain in a remote or hybrid environment3, employees are changing their expectations of when and where work gets done, driving demand for and access to technology tools and services. This is also accelerating enterprises’ transition from on-premise to cloud solutions to decrease costs and maximize resilience and flexibility. However, many companies lack the internal capabilities or resources, in part due to current talent gaps, to implement, manage, and renew IT products and services. This, compiled with the rapid advancement of new technologies, presents a challenge to companies looking to stay up to date with in-house IT expertise.

- Proliferation of IoT: Today, global IoT revenue stands at $440.9 billion and is expected to grow at a 10.2% CAGR to $1,058.1 billion in 20304, driven by several factors. IT infrastructure continues to develop and user experience is improving through the advent of 5G, edge computing, and cloud migration. In addition, Moore’s Law stands, decreasing the cost per CPU memory and storage for IoT devices and cloud servers, while increasing computational power per dollar increase. With more devices connected in consumers’ homes and dependence on networks increasing, device upgrades will happen more frequently.

Paths to Growth

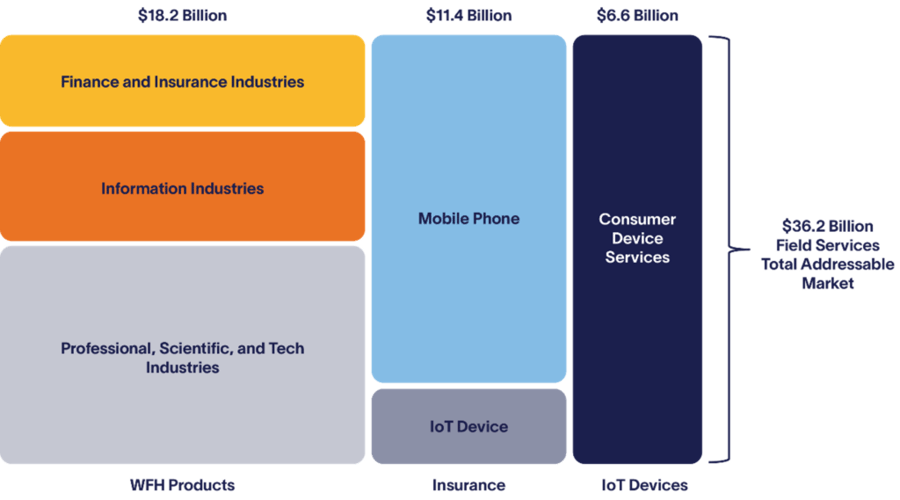

These enduring cultural changes in the way we work have created a large and attractive market opportunity for operators in field services, device OEM, and insurance sectors, with the market expected to reach $36.2B in 2022.

Home Offices Equipped to Get Work Done Securely

Remote work, whether permanent or in hybrid form, is our new way of working, creating space for field service operators to install, troubleshoot, and support mission-critical devices used by remote workers. The rise in remote work and demand for high-speed products and connectivity offers the opportunity to provide individual and bundled solutions for employees working from home. This includes ad hoc repair services and packaged solutions combining device installation, upgrades, and ongoing support to troubleshoot unexpected challenges. Employers provide remote workers with a range of hardware, including corporate issued computing devices, enterprise grade BYOD devices, ergonomic home office furniture, and high-end communication devices such as HD cameras and external microphones. Employee remote working needs will continue to evolve as new and improved technology and telecommunications products become available.

The move to remote work, while convenient, has heightened cybersecurity risks as companies look to keep data secure outside of the four walls of an office building. A jump in phishing emails (the most common source of data breaches when working from home), a decline in cybersecurity training provided to employees, and an increase in daily malware are just a few alarming trends that have emerged from the COVID-19 pandemic. From laptops to smartphones, security of corporate devices is an urgent opportunity area for field services providers, where bundled technology solutions and insurance can come into play.

White-Labeled Home Offerings

Technology-driven innovation in recent years has made consumers increasingly dependent on IoT-powered devices and the technology at their core. Devices tend to focus on security and connectivity, including home monitoring sensors, security cameras, and home waypoints. 5G and edge are making these devices faster and easier for consumers to use, seamlessly integrating into their lives with sophisticated user interfaces and experiences, ultimately increasing stickiness.

While these devices bring added efficiency to everyday personal and professional lives, they can come at a cost. Purchasing the device(s), maintaining the hardware, and regularly upgrading the software adds up quickly, opening a door for third-party providers to ease the burden of staying connected. This can be a natural expansion for field services providers who are already installing and maintaining complex technology devices in offices and homes.

Retrofitting Legacy Workspaces for Hybrid Workers

As we emerge from the pandemic, companies continue to balance remote work and return-to-office. While most of the working population has adapted during COVID temporarily, the needs for equipment are now more long term and therefore many offices need a path to upgrade or replacement. Technology and Financial Services industries are among those facing greater debate internally around bringing employees back into offices, and the continued tightening of the labor market and competition to recruit new talent will put pressure on the remote/hybrid work holdouts to adapt. For these industries, there is opportunity not only to outfit employees’ homes with the high-speed technology, but also to upgrade their office spaces through the installation and delivery of updated displays, high bandwidth interconnected wirings, and high capacity & wide coverage networking equipment to support seamless interfacing between in-office and remote employees.

Insurance Carrier Partnerships for Competitive Edge

Recently, field services operators have begun providing insurance for consumers entrusting them with installing and maintaining their work-from-home setup. The global IoT insurance market is expected to grow to $317.31 billion by 2030 at a CAGR of 56.2%5, while the global mobile phone insurance market is currently sized at $27.29 billion, expecting growth at a CAGR of 10.4% to reach $53.16 billion by 20286. This sector growth presents an opportunity to capture key market share and consumer sentiment.

Today, field services operators are beginning to partner with insurance providers to further strengthen the trust they have already built with consumers. For a premium price, consumers can safeguard themselves from the added stress and high costs of unanticipated hardware or software malfunctions and the associated repair services, after the initial installation. From large OEMs and carriers to smaller third-party providers, more field services operators are adopting this partnership model to meet additional consumer needs and offer an added layer of security and trust on top of technology services.

While this is gaining momentum today, the untapped potential for field services companies to leverage data they gather through consumer interactions provides new value opportunities. Not only has a large, captive market been established around device services, but operators have also built a rich database of customer data that is invaluable in defining a competitive premium pricing strategy – and data that insurance carriers do not have. This data can also offer insight into the risk profiles of potential claim holders, which will shape pricing and protection for various segments served. This competitive advantage can enable operators to strategically negotiate with insurance providers and help them choose the most suitable partners.

Growing Business Models to Capture Market Share

With hybrid and remote work models here to stay, companies are adapting their workspaces and employee programs to support this transition. In response, field services operators have an opportunity to find their niche in a crowded market by expanding their business model and suite of offerings. Operators should strive to:

- Build on trust they have cultivated in a large, captive market to expand and bundle their services. Beyond providing repair services, consider the lifecycle of needs that remote workers have, from outfitting their home office to upgrading software and occasionally troubleshooting through tech troubles. Providers should also identify opportunities to package services into the “ultimate hybrid work-home bundle” to provide long term security to consumers.

- Apply more specific, data-driven segmentation across the target market to inform product and pricing strategies to remain competitive in a crowded marketplace.

- Embrace the value of partnerships with insurance carriers. Building on growth in IoT and mobile device insurance markets, providers can combine field services and device insurance coverage to foster strong customer sentiment with added security.

Sources:

1 WFH Research

2 IBISWorld

3 Gartner

4 Allied Market Research

5 Market Research Future

6 Insights Partners