INSIGHTS

Fan-Focused Tech, Women’s Sports, and New Opportunities in Global Sports

Altman Solon’s survey shows that social media, VR/AR, emerging digital technology, and ‘’snackable’’ content are engaging fans who are spending more time watching live sports post-pandemic.

Global sports – and how we consume them – are transforming, creating new opportunities for sports properties, investors, and media partners. Altman Solon’s 2022 Global Sports Survey reveals growth in viewership and consumption of sports content – including women’s sports – as well as in the overall number of sports viewers over the past two years. The survey also finds that fans are attracted to new technologies – from virtual and augmented reality to NFTs – that enhance the viewer experience and have the potential to create deeper connections to clubs and leagues. These exciting new developments come as global rights fees and franchise valuations remain sky-high, with several billion-dollar transactions occurring in the last year alone.

This article outlines key insights and perspectives from Altman Solon’s 2022 Global Sports Survey, which gauged sports interest, viewership and preferences, willingness to pay for sports programming, and international fandom of top global leagues from more than 17,000 respondents across 17 countries in North America, Europe, Latin America, and Asia-Pacific. The survey was conducted from July to August 2022. Additional insights from the survey will be published this fall.

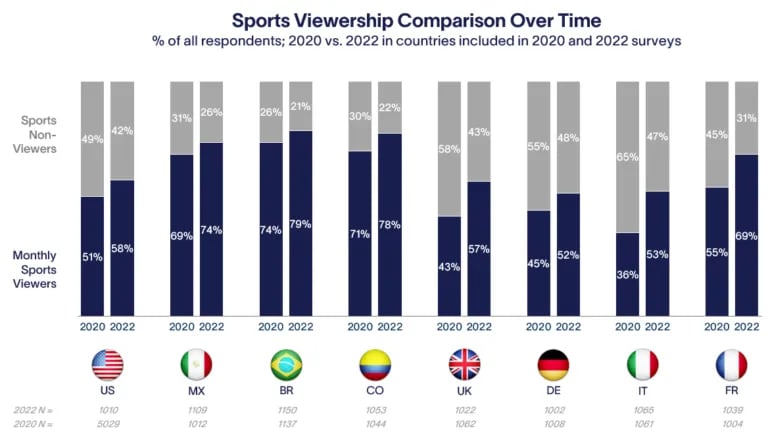

Sports viewing is more popular post-pandemic

While sports viewing has always been popular globally, interest in sports has increased since the COVID-19 pandemic. The survey shows a rise in the popularity of watching live sports today compared to 2020, which saw the cancellation or postponement of many live sporting events – including high-profile events like the 2020 Summer Olympics in Tokyo and thousands of games globally. The percentage of those watching live sports grew in all eight countries included in both the 2020 and 2022 surveys as sports have come roaring back since the pandemic, and audiences and fans have followed.

How fans are watching sports is changing

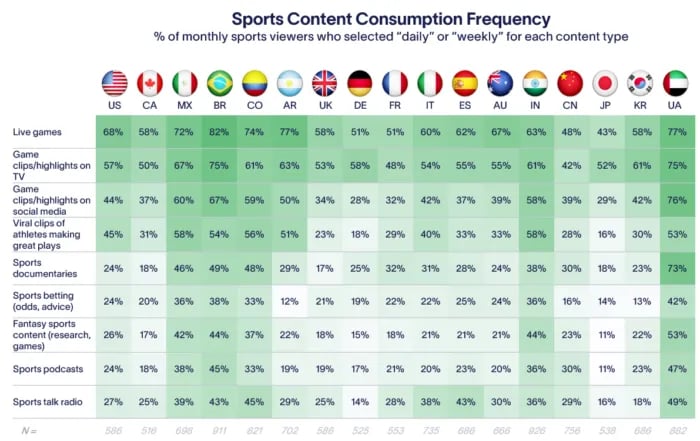

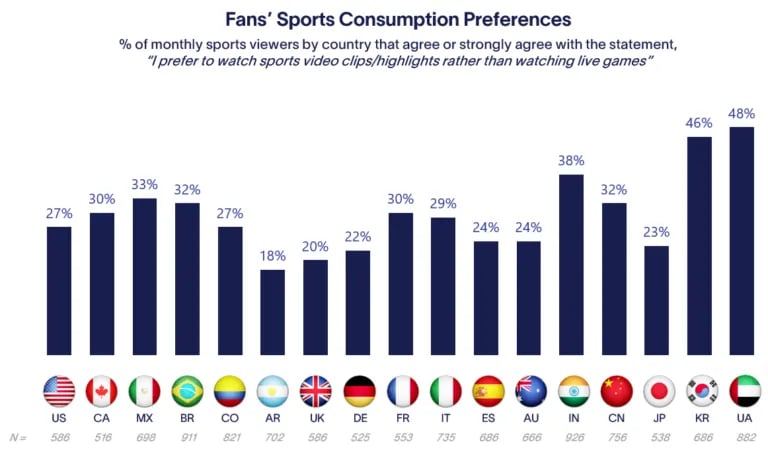

While the traditional methods of watching sports – live on pay TV or through streaming/OTT – are resilient, a large group of global fans are forgoing watching live events for game recaps, highlights, and clips on social media. In nearly every country, “live games” were selected as the most frequently consumed sports content on a daily or weekly basis, but watching game clips on social media was a close second. In many markets, watching highlights on social media proved very popular. Finding a way to balance serving the traditional fanbase while attracting new demographics of fans who prefer more short-form, “snackable” sports content will be critical to competing in the new sports marketplace.

Not only are there now more sports fans globally, but many sports fans are also increasing the hours of sports content they watch compared to 2020. The results show that, in nearly every survey market, at least one-quarter of global sports fans are watching more sports content than they did in 2020, with a similar percentage watching more live sports. But other survey findings point to the different ways fans are enjoying their favorite sports content, with sizeable groups – 27% in the U.S. and 20% in the U.K. – preferring to watch video highlights of the game than watching the match itself.

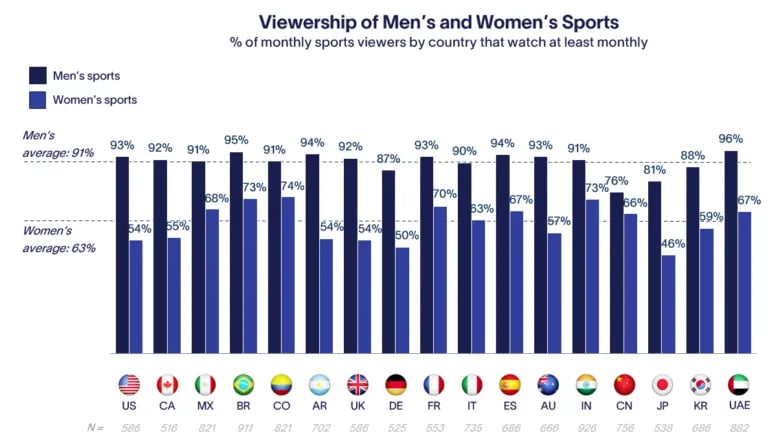

Women’s sports step into the spotlight

From the thrilling Women’s Euro Final between England and Germany in a packed Wembley Stadium to Serena Williams’ emotional last run at the U.S. Open, 2022 delivered an unforgettable summer for women’s sports. The survey reinforces that women’s sports have become a powerhouse, with a majority of sports fans in nearly every country measured – and 63% globally – saying they regularly watch women’s sports. This growing popularity shows that investments made in women’s sports, particularly in European football, are starting to pay off.

VR/AR offer new realities for sports fans

In addition to changes in what sports fans watch, the survey identifies innovations that are transforming how they consume their favorite content.

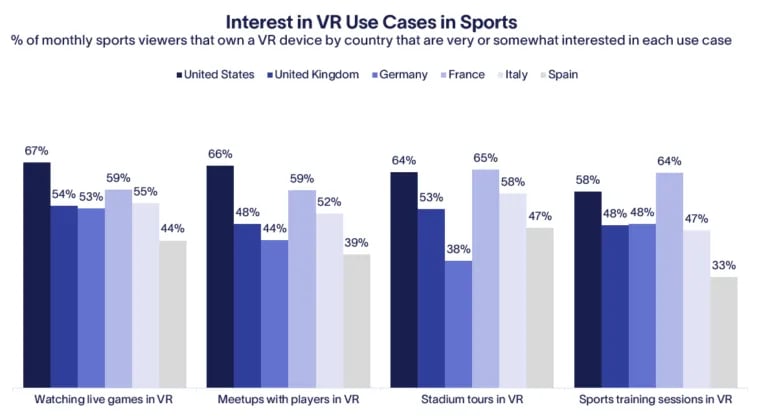

The survey finds strong interest in using Virtual Reality technology to interact with sports content at home, as owners of VR headsets are consuming sports VR content at a high rate. The U.S. and Japan had the highest levels of interest in using VR for sports, with more than two-thirds of U.S. headset owners interested in watching live games in VR. Other popular VR uses include watching live games as if inside the arena and experiencing live action from a player’s point of view.

Using VR to improve at-home fan viewing is not the only digital experience sports entities offer. Augmented Reality (AR) is being employed at stadiums to bolster fan enjoyment and deliver virtual on-field advertising. Some teams, including the Southampton Football Club in the English Premier League, are selling AR-enabled merchandise that allows fans to scan codes on jerseys to access more club content. If VR technology continues to evolve – and the expansion of the metaverse attracts more visitors – clubs, leagues, and athletes will have many new opportunities to build and market new digital worlds for their fans.

NFTs and crypto show potential as new sports currencies

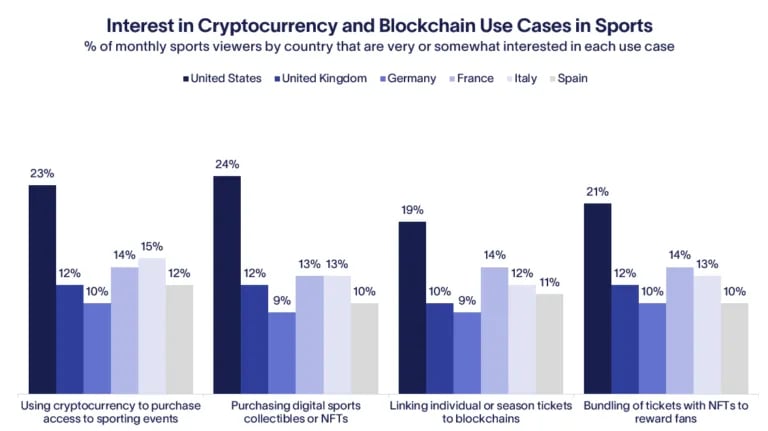

Investors and sports entities are starting to make big bets on alternative technologies – ticket payments through cryptocurrency, sports-related NFTs, fractional ticket ownership, and digital fan tokens – as a way to develop deeper relationships with fans. Despite being in their infancy, these offerings are already drawing the attention of global sports fans.

Most of these digital technologies have at least 20% interest across a majority of countries in the survey, with overall interest highest in India, Japan, the United Arab Emirates, and Latin America. U.S. fans have a solid interest in alternative technologies, with respondents choosing to buy NFTs or digital collectibles (24%) and use cryptocurrency to attend sporting events (23%) at the highest rates. European interest was generally lower, with German and U.K. fans showing about 10-15% interest across all categories.

Overall, the potential use cases for cryptocurrency and NFTs in sports will encourage the expansion of digital technologies at the league, team, and athlete levels, generating substantial revenue for rights holders while also creating deeper fan engagement.

With the sports industry evolving due to technological innovations and changes in fandom, significant opportunities exist for leagues, their partners, and investors. Those who best adapt to these changes will have a leg up on their competitors.

Altman Solon's Global Perspective on Sports report, which is available upon request, provides more details on how sport is evolving across 17 countries.