NEWS & EVENTS

Staying at home: why 20 million workers will continue remote work after COVID-19

- Up to 55% of US “knowledge workers,” more than 50 million people, are working from home (WFH) because of COVID-19

- Now accustomed to WFH, 20 million knowledge workers will work from home more often after COVID-19 crisis

- Tech and telecom firms should be ready to enable that

COVID-19 has spread rapidly across the globe, reaching nearly every nation and costing tens of thousands of lives so far. While protecting public health is the clear priority in this pandemic, there has already been an unprecedented impact on the global economy with massive job losses and plunging stock market indexes.

Altman Solon clients have asked us over the last couple of weeks for our views on the near- and long-term impacts of this crisis. This article represents the next installment in a series of articles that dive deeper into different aspects of the crisis and how they will impact our lives, our work, and the Telecommunications, Media and Technology (TMT) industries we rely on. Past entries include an overview of TMT trends, a look at what sports fans are doing to fill the void left by the professional sports blackout, and an in-depth consumer survey on employee remote work trends affecting telecom and tech providers.

Understatement of the Year: More workers are working from home now than ever before

No one knows for certain exactly how many people are working from home (WFH) as a result of shelter in place policies, directives from employers, and individual employee preferences, but we know it’s happening.

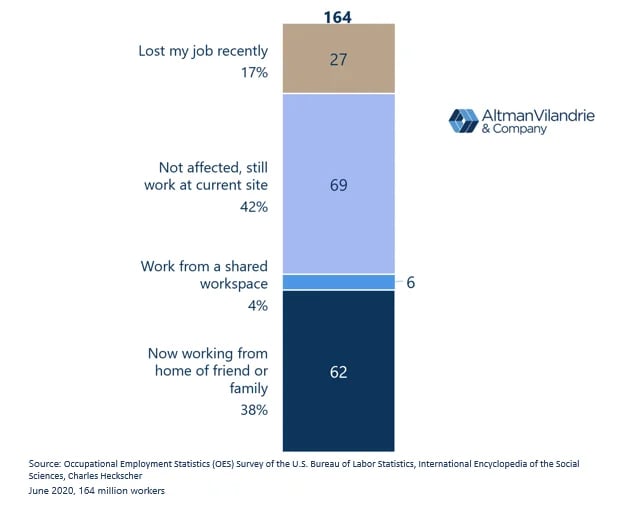

In our recent survey we found that up to 38% of the U.S. labor force is now working from home — that’s potentially 62 million workers. It’s unclear what this number was before the COVID-19 crisis. According to the U.S. Bureau of Labor Statistics, in 2017-18, only 15% of US workers worked from home for a full day or more per week. Another estimate states just 3.6% of the labor force was working from home full time before the crisis. If this is accurate, the shift to 38% represents a remarkable increase of about 1000%.

Est. Share of US Labor Force by Work Site & Status

Knowledge Workers may represent 90% of workers shifting to WFH

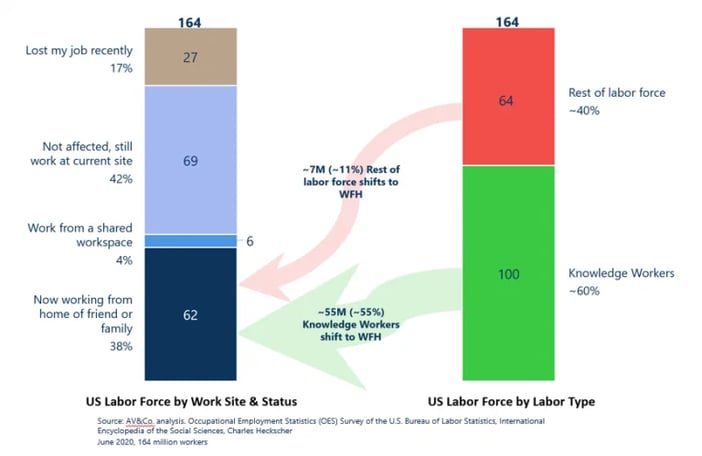

There are approximately 100 million knowledge workers in the US (sometimes referred to as “white collar” workers), representing about 60% of the labor force. Generally, these folks work in offices, sit, or stand at desks; collaborate with colleagues in conference/meeting rooms; and utilize desktop phones, laptop computers, and other “productivity tools” we associate with an office setting. They are significant consumers of information technology (IT) and telecommunications products and services, though these solutions are largely procured on their behalf by company IT and operations departments.

Occupation Categories: Knowledge Worker & Rest of Labor Force

The rest of the labor force, about 64 million, works in “non-office” settings: factories and plants, retail establishments, and other worksites. Many of these workers are likely unable to work, let alone work from home, during the current crisis, unless their industries are considered essential, such as grocery stores, logistics firms, or government infrastructure.

Of the 62 million Americans now working from home, we believe the lion’s share, perhaps 90%, are knowledge workers. This translates to 55 million knowledge workers currently working from home, or about 55% of that segment. This is a staggering shift in how knowledge workers are carrying out their duties, with major implications for how they consume IT and telecom services.

Est. Share of US Labor Force Shifting to WFH by Labor Type

WFH is changing how knowledge workers consume IT and telecom services

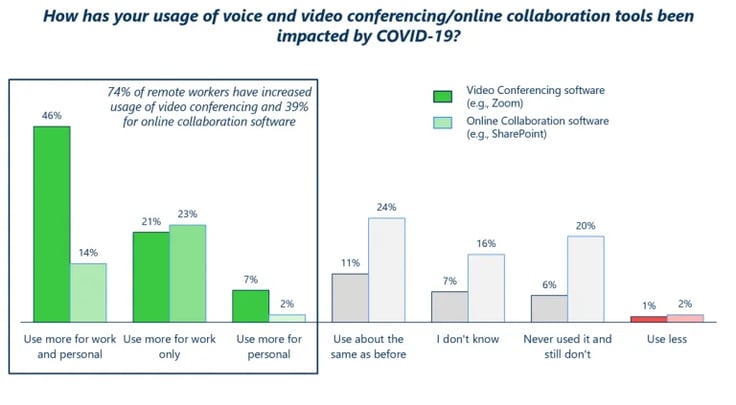

The WFH boom is also driving workers to leverage productivity applications differently. For example, a whopping 74% of those working from home stated they are using video conferencing (Zoom, Skype) more than in the past, and 39% stated they are using online collaboration tools (Microsoft SharePoint) more. The reasons are obvious: no more in-person meetings or other forms of in-office collaboration, formal or informal. The spontaneous chats with co-workers in halls and chance to grab a quick lunch together have also disappeared.

Our survey identified “pain points” associated with working from home, some technology-related and others more practical or personal. For example, approximately one-third of respondents stated “family or personal distractions” were disrupting their productivity. But overall, knowledge workers appreciate the opportunity to continue working despite the crisis and believe they are mostly productive at home.

Both employees and employers are learning in real time how to make WFH work. Having experienced it, they are unlikely to revert to pre-crisis behaviors once the crisis subsides. This is not meant to suggest that 60 million people will continue to work from home as they do now, which would be impractical. But now exposed to working from home, and experiencing the advantages/disadvantages firsthand, employees will do it more often, and employers will have a hard time convincing employees to go back to pre-crisis work modes.

Adoption dynamics of productivity applications suggest how this plays out

We have seen similar scenarios in our client work for tech and telecom companies. Specifically, Altman Vilandrie & Company has assisted numerous clients evaluate the likelihood that their customers (and prospective customers) would switch from current productivity applications to new solutions. Think of productivity apps as the horizontal applications nearly every knowledge worker uses, including email, word processing, voice calls, instant message/chat, audio/video conferencing. Most employees do not feel passionate about the vendors delivering these solutions, but all utilize them. These apps are ingrained into our work routines. Contrast this with applications that are highly vertical in nature (airline ticketing systems, retail point of sale systems) or functional applications (CRM, ERP, HRIS). For these applications, a smaller share of the employee base interfaces with them, but the perceived value of those applications is high because of the functionality they deliver, including lead tracking, sales pipeline, and sales commissions processed by a CRM system.

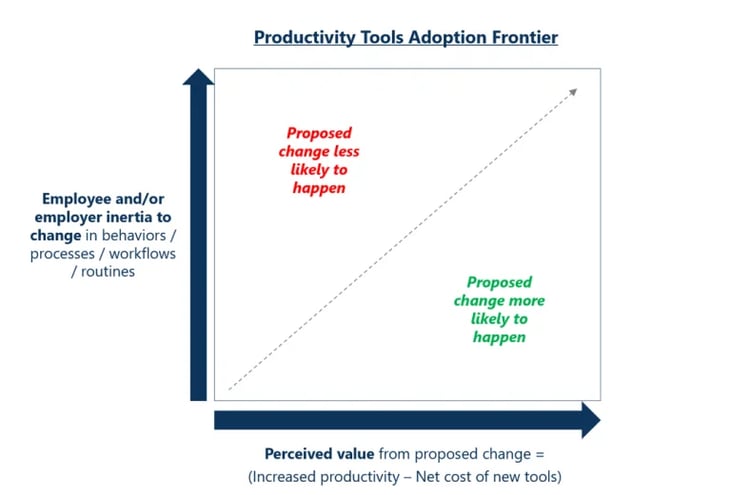

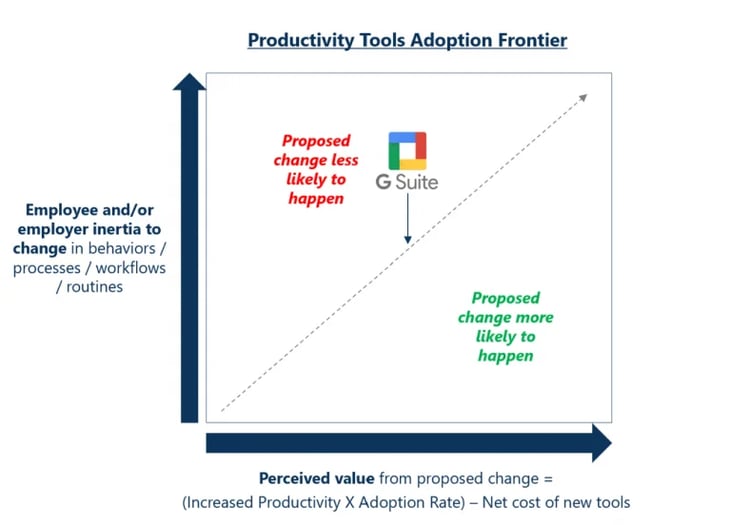

Across many projects, we have found that the value proposition of the new solution was only one element of the decision to adopt it. As important, if not more, was the extent users of the new solution would have to change current behaviors, workflows, and general work habits in order to use it. The more “behavior change” required the less likely the new solution would be adopted. And the more employees currently using the application, the more change that is implied. In fact, in our experience, new productivity apps must present a dramatically outsized value proposition relative to current tools if they hope to see adoption.

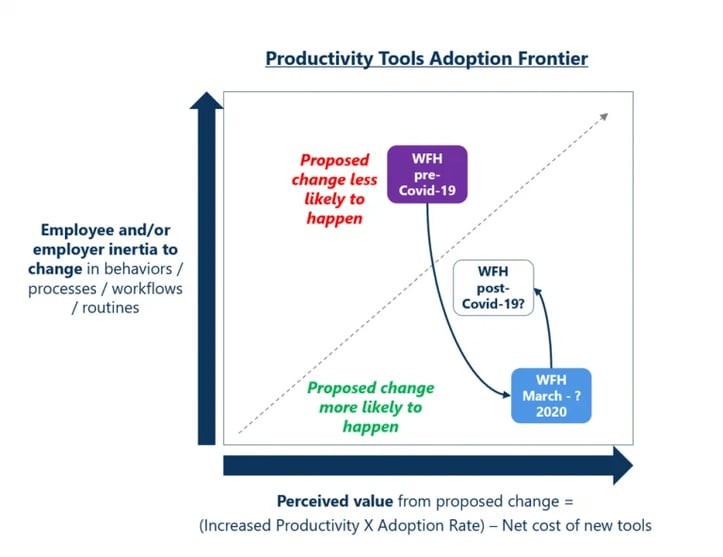

However, that dynamic flips when change is forced on employees, such as a corporate mandate during a pandemic, when the value proposition needs only to be minor for the new solution to gain traction. If employees are forced to use a new application, or behave differently, the resistance to change essentially evaporates. They will use the new app because they are required to do so. When the mandate is lifted, employees, accustomed to the new app and their changed behavior (now their new behavior), will want to continue using it. And employers, now also accustomed to it, will have a hard time pushing back.

We call this dynamic the Solution Adoption Frontier, displayed below. The X-axis addresses the value proposition of the new solution and the Y-axis represents inertia to changing behaviors associated with using the new solution. Per the framework, the greater the required change in behavior to use a new application, the greater the value proposition must be, or adoption will not happen.

Solution Adoption Frontier Case Study: Microsoft O365 vs Google G-Suite

Case Study: Microsoft O365 vs Google G-Suite

Google’s productivity application suite, G-Suite, presents a classic example of this adoption challenge. G-Suite is comparable to the Microsoft Office 365 suite, though there are certainly some differences in functionality not addressed in this paper. G-Suite is generally priced 30-50% less than comparable Office 365 packages, but Microsoft maintains a consistent 80-90% share of business users.

Why? Despite the incremental value proposition of switching to G-Suite (saving 30-50% of cost), many employers (and employees) have been reluctant to switch due to the related changes in behaviors and workflows required to interface with a new solution. Is learning how to interface with a new email platform really such a burden, given the potential for 30-50% cost savings across thousands of employees at a Fortune 500 company? For more than 80% of companies, apparently so.

The Challenge for Google’s G-Suite

WFH is like adopting a new productivity app; This time we are forced to adopt so it will stick

In the case of COVID-19, inertia to working from home has been largely reduced – WFH has been forced on many employers and employees, and many knowledge workers are happy to have the option. There’s less mystery surrounding WFH and the assumed productivity gains and losses. We’re all experiencing it firsthand and can make our own judgments.

Post COVID-19 crisis, when employees are allowed back into offices, they’ll have clear perspective on when WFH makes sense vs. when it does not. The average company will become “more open” to occasional WFH than their policies allowed before, because it’s part of their new behavior. They eliminated the inertia to change.

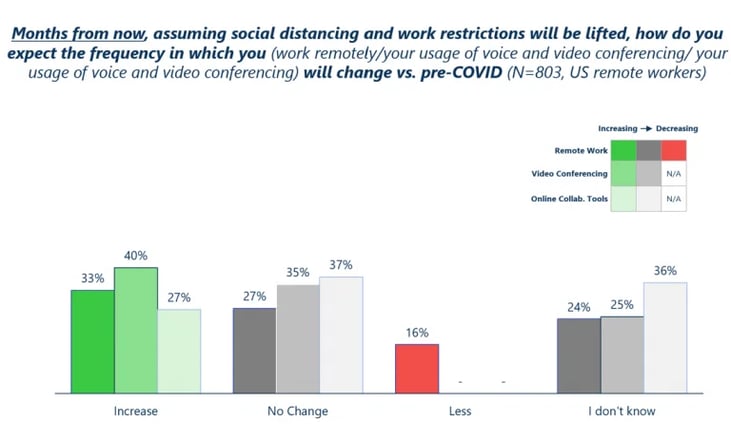

Why We Will Work From Home More Often Per our survey, WFH workers are already thinking along the same lines: post-crisis, 33% expect to work remotely more –that’s 20 million knowledge workers. Also, 40% expect to use video conferencing more, and 27% expect to use online collaboration tools more after the work restrictions are lifted.

Per our survey, WFH workers are already thinking along the same lines: post-crisis, 33% expect to work remotely more –that’s 20 million knowledge workers. Also, 40% expect to use video conferencing more, and 27% expect to use online collaboration tools more after the work restrictions are lifted. One CEO we work with conducts a weekly “happiness” poll of employees to measure how people are feeling week-to-week during the current WFH state. The survey features a “bonus” question, last week it was: “What is the first thing you will do when the stay-at-home order is lifted?” Among the answers that came back: “Request more WFH days in a week.” Another employee stated: “I will miss this period of time when I can save 3 hours of commuting every day.” We are also hearing, anecdotally, that some employers are experiencing increased productivity during the shift to WFH. While attitudes can change significantly in six months, perhaps employers will have more reasons to embrace WFH once COVID-19 recedes.

One CEO we work with conducts a weekly “happiness” poll of employees to measure how people are feeling week-to-week during the current WFH state. The survey features a “bonus” question, last week it was: “What is the first thing you will do when the stay-at-home order is lifted?” Among the answers that came back: “Request more WFH days in a week.” Another employee stated: “I will miss this period of time when I can save 3 hours of commuting every day.” We are also hearing, anecdotally, that some employers are experiencing increased productivity during the shift to WFH. While attitudes can change significantly in six months, perhaps employers will have more reasons to embrace WFH once COVID-19 recedes.

Opportunity for TMT firms that enable WFH? Get ready to enable more of it

The prospect of 20 million more Americans working from home more often over the long term creates a massive opportunity for companies who can outfit and secure home office environments. These players include productivity application publishers; telecoms providing voice and data services; remote security solutions vendors, device/peripheral firms (monitors, keyboards, mice), and a range of services providers, including those who manage applications and infrastructure remotely; and those who deliver and deploy home office equipment. Tech and telecom firms should be aggressively positioning themselves to serve this segment via new awareness campaigns and messaging, special solution bundles (directed at individual workers AND company IT and procurement officers), and even special pricing to capture the most market share during this inflection point.

It goes without saying, the current crisis is far from over. Once it begins to subside, current thinking suggests people will only slowly/incrementally revert to former behaviors, including returning to their offices. Years from now, much of our society will return to its pre-COVID-19 state, but it’s likely many of the work behavior changes we’re making today will persist in some fashion. Beyond how we consume tech and telecom services, this will impact how we engage with colleagues, customers, suppliers, and others from now on.

Look for deeper assessments of the impacts of this crisis on the TMT space from Altman Vilandrie & Company over the coming days and weeks.