Arrow by Altman Solon empowers clients to implement better network deployment strategies for 5G, fiber, and broadband, improving financial returns by more than 50%.

Challenge

For many Communications Infrastructure providers, revenue growth has slowed to low single digits across most markets. At the same time, the unrelenting demand for infrastructure investment persists, including fiber to support internet traffic growth and more business customers seeking adequate service levels to remain competitive.

In this context, the accuracy of fiber deployment cost is critical to defining the business case for expansion and prioritizing the right sets of markets and locations to go after.

Our client, a large North American enterprise fiber provider, was building a business case for a brownfield expansion in more than eight markets, to serve thousands of additional locations identified as attractive. However, the client had determined that their process to estimate fiber miles was flawed. The approach identified as-the-crow-flies distances from each location to its closest neighbor location or existing fiber, then applied a fixed multiplier (e.g. 1.75x) to estimate the fiber mileage and costs.

The approach raised questions about the accuracy of cost estimates and caused significant delays in deployment decisions due to a lack of confidence in the cost model and accompanying business case.

Solution

The Altman Solon team leveraged our Arrow platform to run multiple fiber build scenarios, develop the accompanying business case, and prioritize the right sets of locations to pursue given more accurate cost estimates.

Arrow by Altman Solon leveraged available conduits to model the exact fiber routes needed to connect all locations (100% scenario) and expand from the existing network splice points. Rather than applying a simplistic, as-the-crow-flies approach, the platform ingests multiple conduit types (e.g. road segments, underground fiber conduit, aerial pole data) and leverages routing algorithms to determine the most efficient route, factoring in both distance and cost and fusing different conduit types as needed. Arrow by Altman Solon’s approach delivers significantly more accurate cost estimates and reflects the real-world fiber build scenario.

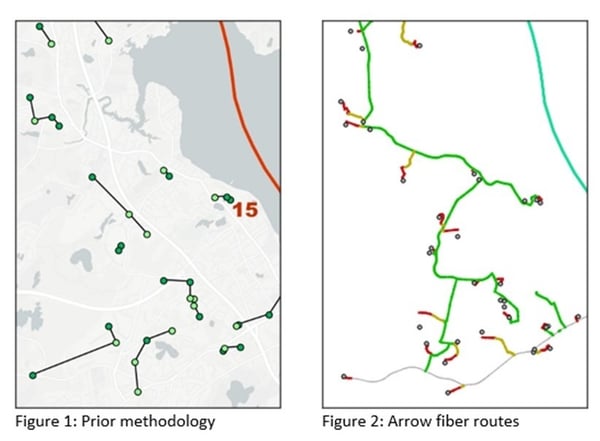

Figure 1 (below) shows the prior technique used to estimate fiber, which estimated the need for approximately 2,000 miles of new fiber to reach the priority locations. In comparison, Figure 2 is taken from Arrow by Altman Solon’s routing algorithms targeting the same sets of locations. The platform provides a more accurate view of the required fiber routes. In this case, it is estimated that 4,000 miles of new fiber are required to reach the same set of locations – or a 2x increase in build cost.

To further refine the analysis, Arrow by Altman Solon’s network architecture configuration setting was used to avoid building the last 500 feet of network proactively and instead build that on a success-based capex in line with the client’s approach to expanding in this market.

In addition, three additional scenarios were run for each market with varying coverage targets – 95%, 90%, 85%. In each scenario, the platform’s pruning logic was used to automatically remove the locations with the lowest capital efficiency from each scenario. This approach allowed the client to reexamine its original priority locations and build a more promising business case for expansion.

Results

The original methodology was underestimating fiber miles by 50%, resulting in an inaccurate business case and causing significant bottlenecks in the network planning and deployment process. Arrow’s analysis improved estimates by 50% and enabled a more conservative business case to be created with fewer target locations.

For this expansion project, fiber miles initially increased by 2x, which turned the business case negative. However, in a follow-up analysis using Arrow’s pruning logic (removing the low IRR sections of planned builds), mileage was cut by ~40% while only removing 15% of business locations. As a result, Arrow by Altman Solon created a positive business case by targeting high-IRR locations.

Using different coverage scenarios for each market, the client was able to build a positive business case again, but this time with much more realistic fiber build expectations and improved location targeting.